System Understanding Aid 9th Solution Manual Full Set Transaction

Accounting Information Systems

39 Describe and Explain the Purpose of Special Journals and Their Importance to Stakeholders

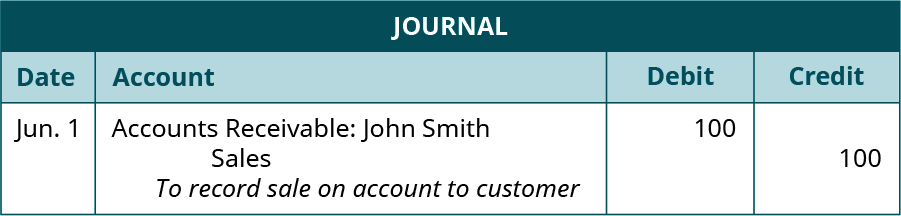

The larger the business, the greater the likelihood that that business will have a large volume of transactions that need to be recorded in and processed by the company's accounting information system. You've learned that each transaction is recorded in the general journal, which is a chronological listing of transactions. In other words, transactions are recorded into the general journal as they occur. While this is correct accounting methodology, it also can create a cumbersome general journal with which to work and may make finding specific pieces of information very challenging. For example, assume customer John Smith charged an item for $100 on June 1. In the general journal, the company would record the following.

This journal entry would be followed by a journal entry for every other transaction the company had for the remainder of the period. Suppose, on June 27, Mr. Smith asked, "How much do I owe?" To answer this question, the company would need to review all of the pages of the general journal for nearly an entire month to find all of the sales transactions relating to Mr. Smith. And if Mr. Smith said, "I thought I paid part of that two weeks ago," the company would have to go through the general journal to find all payment entries for Mr. Smith. Imagine if there were 1,000 similar credit sales transactions for the month, each one would be written in the general journal in a similar fashion, and all other transactions, such as the paying of bills, or the buying of inventory, would also be recorded, in chronological order, in the general journal. Thus, recording all transactions to the general journal makes it difficult to find the particular tidbits of information that are needed for one of our customers, Mr. Smith. The use of special journal and subsidiary ledgers can make the accounting information system more effective and allow for certain types of information to be obtained more easily.

Using General Ledger (Control) Accounts

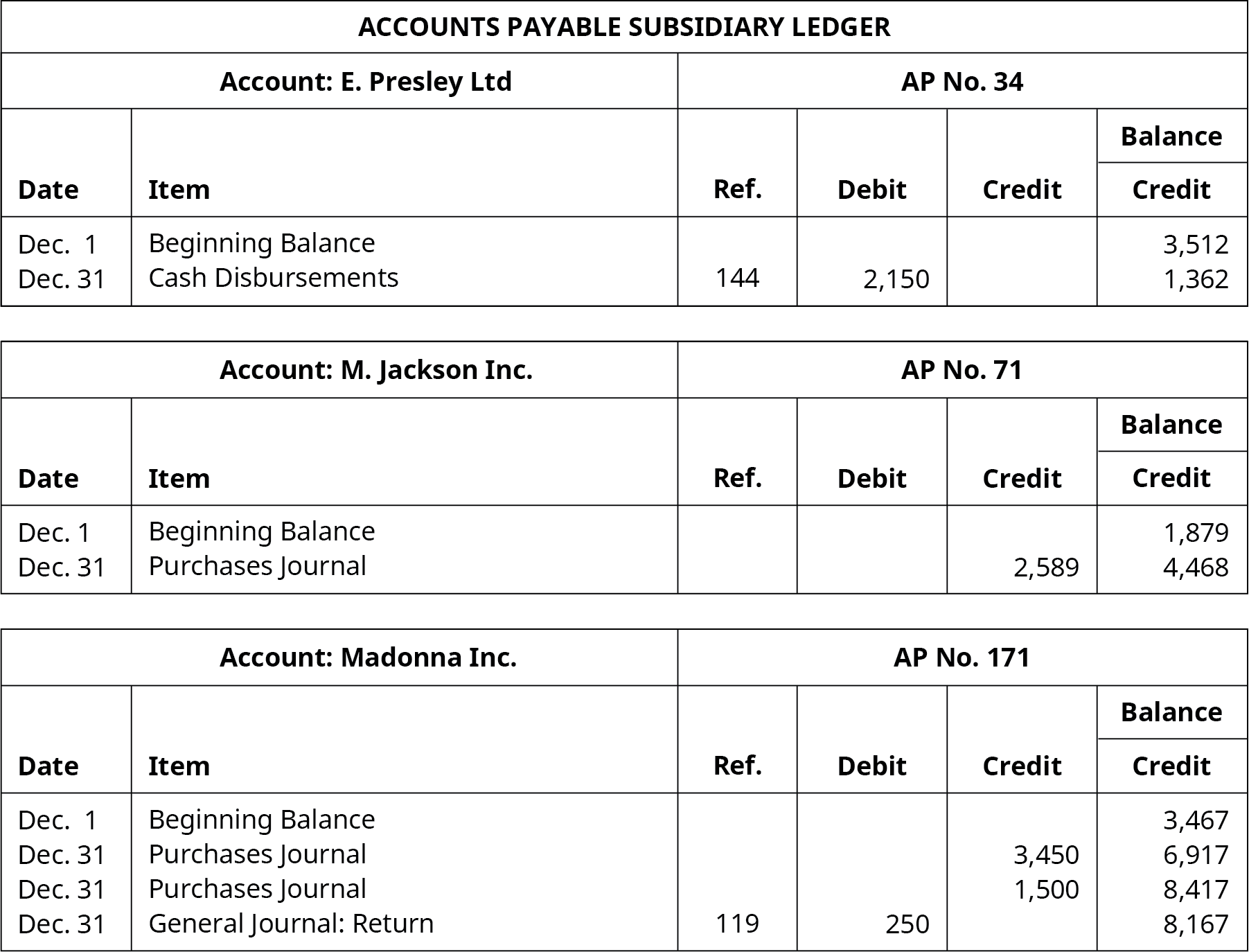

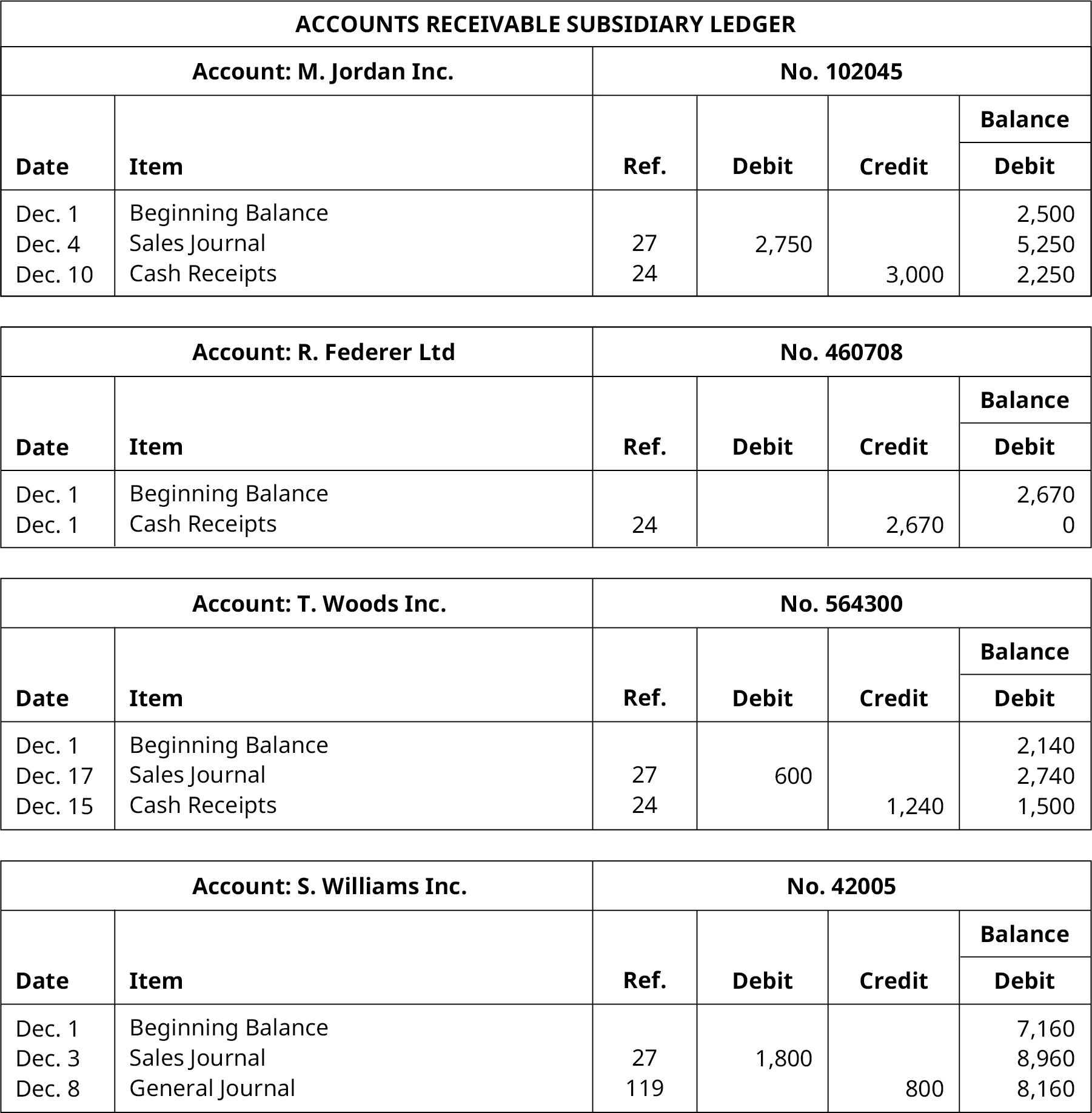

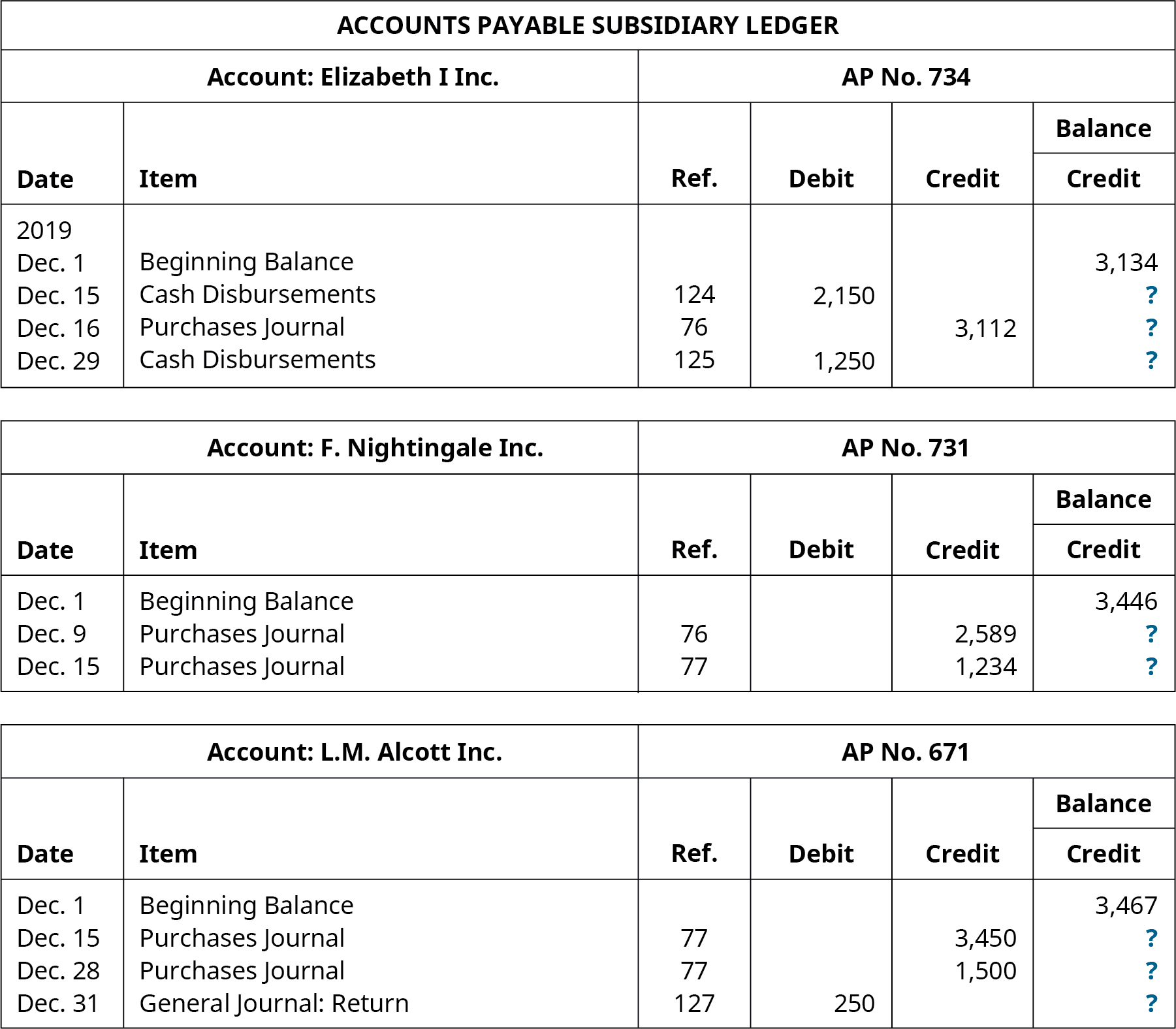

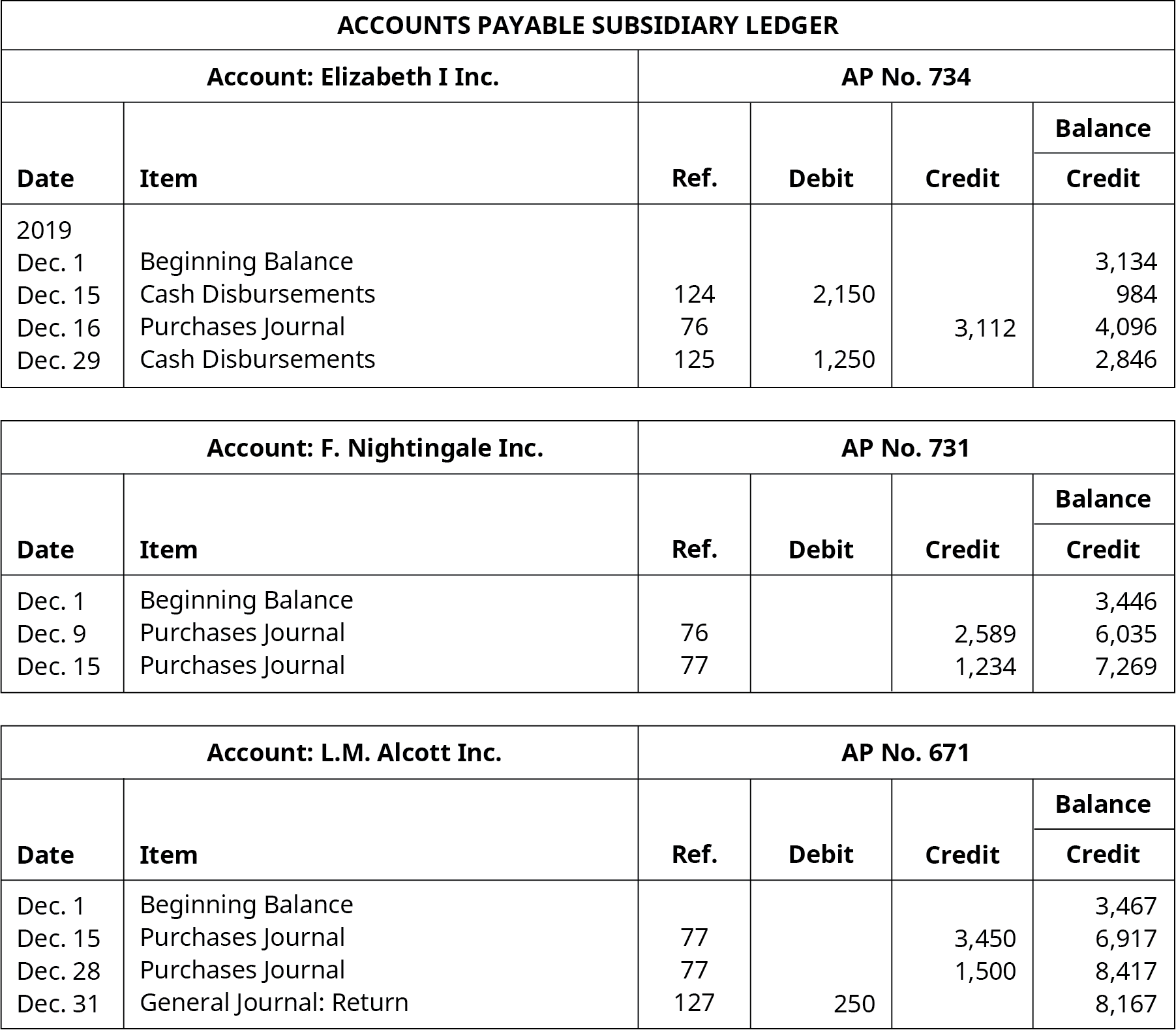

Here is the information from the accounts payable subsidiary ledger:

What should the total be in the Accounts Payable Control Total?

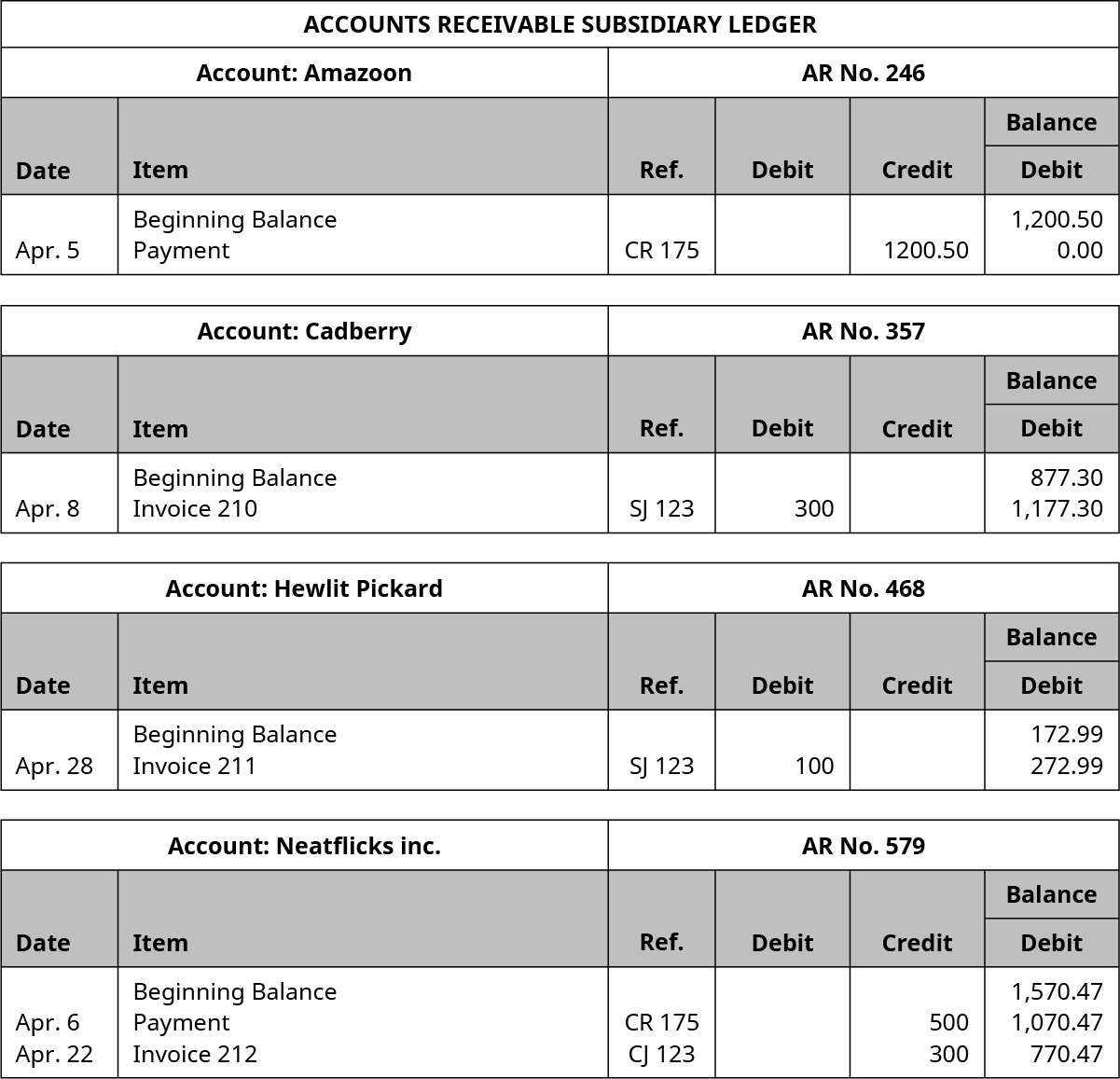

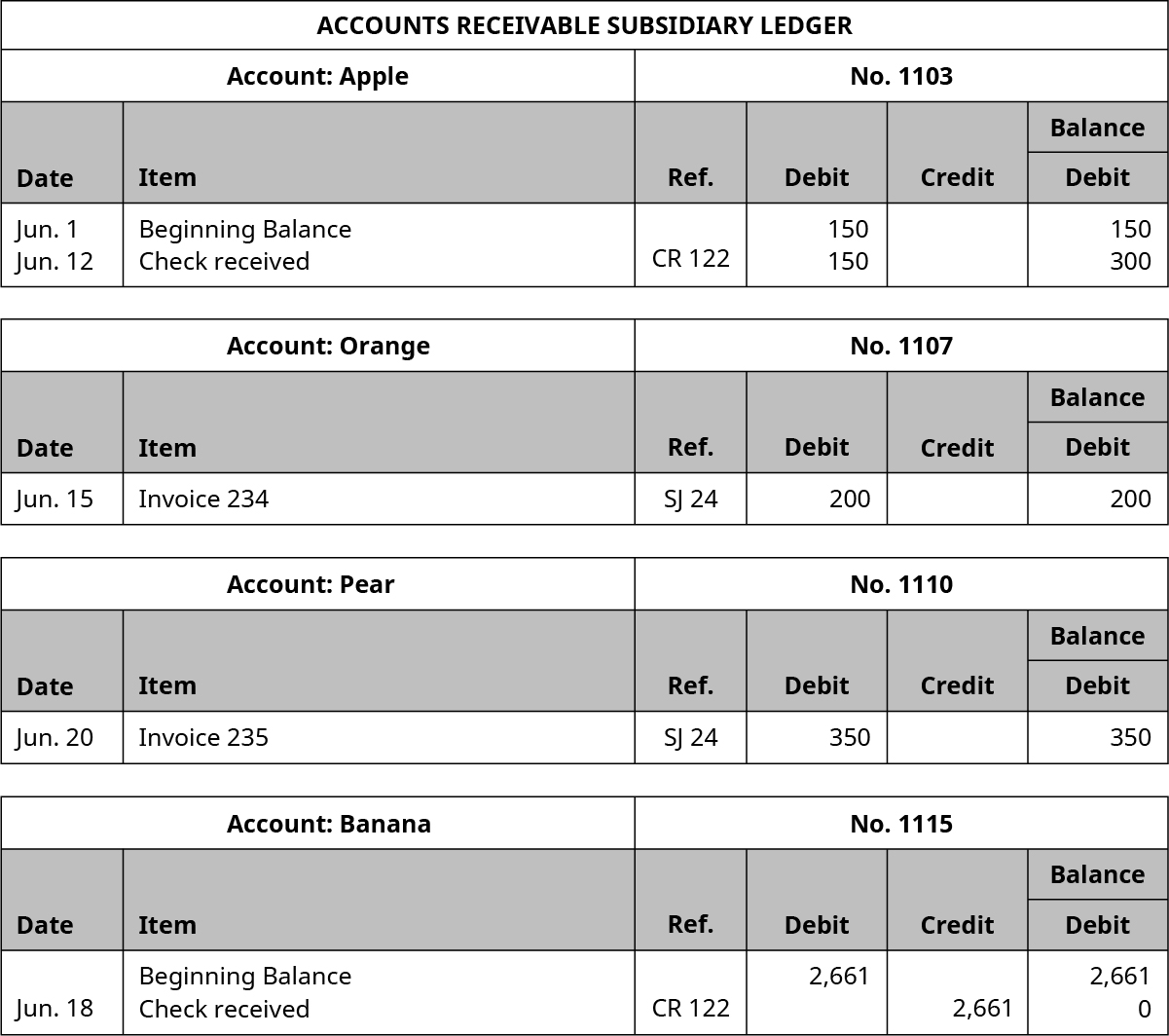

Here is the information from the accounts receivable subsidiary ledger.

What should the total be in the Accounts Receivable Control Total?

Solution

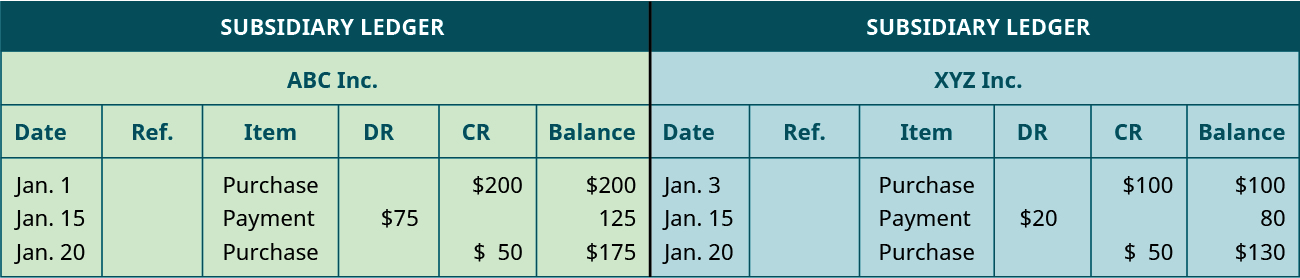

Accounts Payable Control Total is: 1,362 + 4,468 + 8,167 = 13,997

Accounts Receivable Control Total is: 2,250 + 0 + 1,500 + 8,160 = 11,910

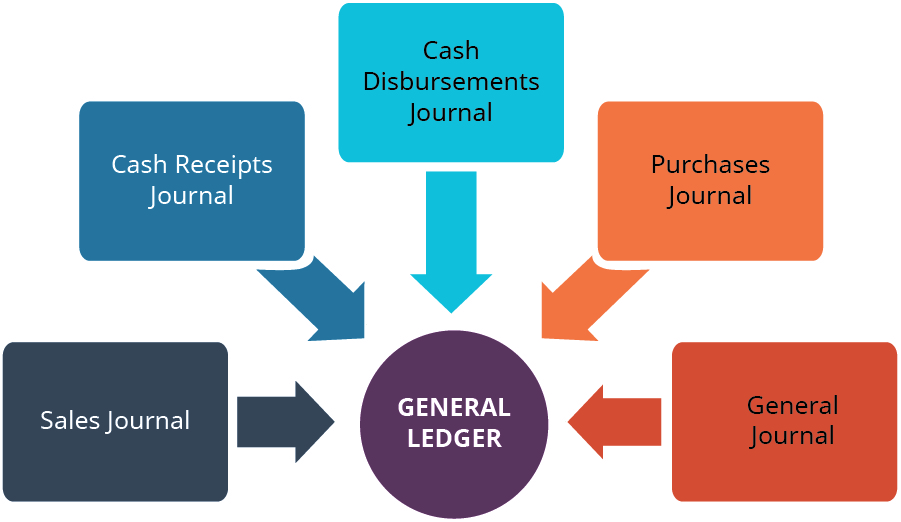

Special Journals

Instead of having just one general journal, companies group transactions of the same kind together and record them in special journals rather than in the general journal. This makes it easier and more efficient to find a specific type of transaction and speeds up the process of posting these transactions. In each special journal, all transactions are totaled at the end of the month, and these totals are posted to the general ledger. In addition, instead of one person entering all of the transactions in all of the journals, companies often assign a given special journal's entries to one person. The relationship between the special journals, the general journal, and the general ledger can be seen in (Figure).

Special and General. Transaction summaries form the special journals, and all transactions in the general journal are posted to the general ledger. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

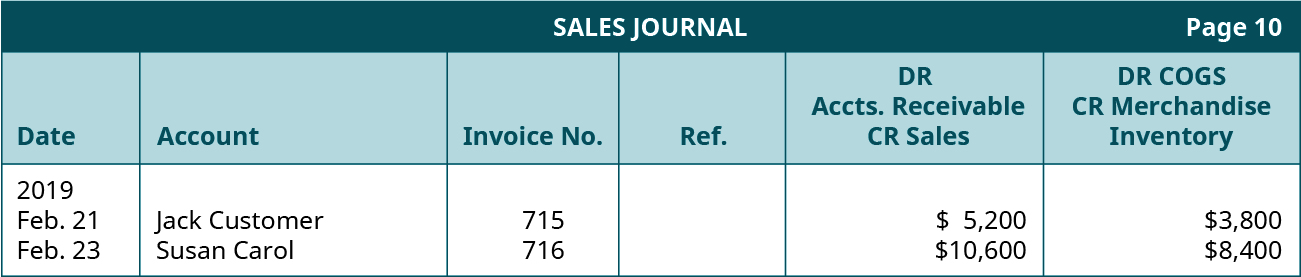

Most companies have four special journals, but there can be more depending on the business needs. The four main special journals are the sales journal, purchases journal, cash disbursements journal, and cash receipts journal. These special journals were designed because some journal entries occur repeatedly. For example, selling goods for cash is always a debit to Cash and a credit to Sales recorded in the cash receipts journal. Likewise, we would record a sale of goods on credit in the sales journal, as a debit to accounts receivable and a credit to sales. Companies using a perpetual inventory system also record a second entry for a sale with a debit to cost of goods sold and a credit to inventory. You can see sample entries in (Figure).

Sales Journal. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Note there is a column to enter the date the transaction took place; a column to indicate the customer to whom the transaction pertains; an invoice number that should match the number on the invoice given (in paper or electronically) to the customer; a reference box that indicates the transaction has been posted to the customer's account and can include something as simple as a check mark or a code that links the transaction to other journals and ledgers; and the last two columns that indicate the accounts and amounts debited and credited.

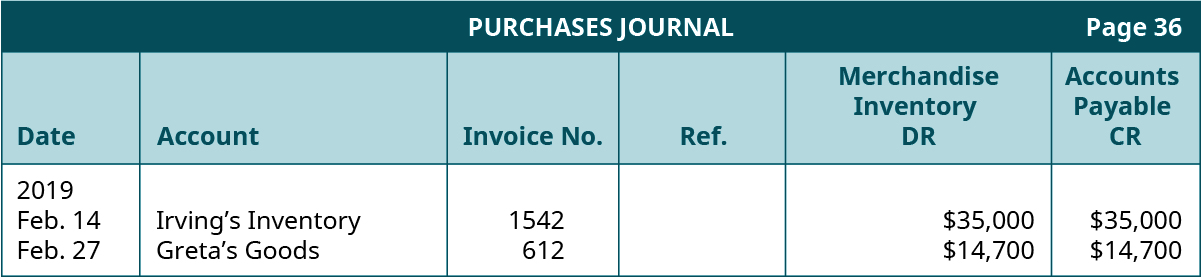

Purchases of inventory on credit would be recorded in the purchases journal ((Figure)) with a debit to Merchandise Inventory and a credit to Accounts Payable.

Purchases Journal. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

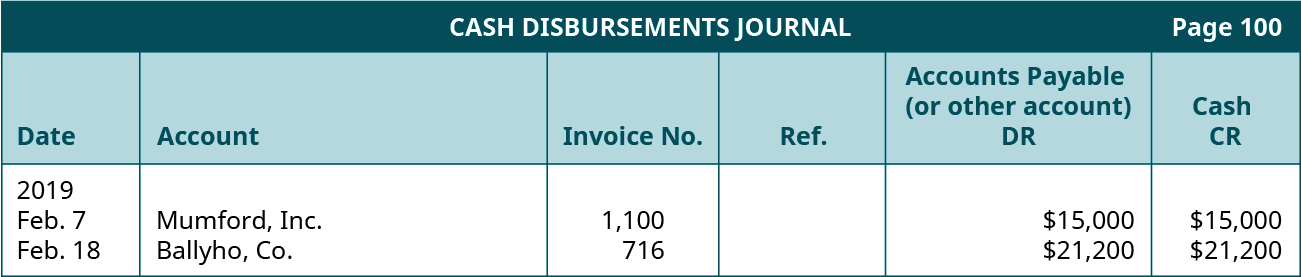

Paying bills is recorded in the cash disbursements journal ((Figure)) and is always a debit to Accounts Payable (or another payable or expense) and a credit to Cash.

Cash Disbursements Journal. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

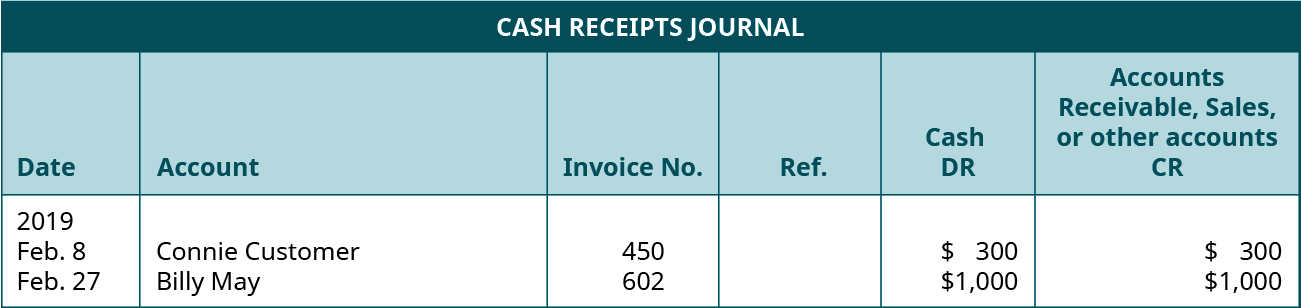

The receipt of cash from the sale of goods, as payment on accounts receivable or from other transactions, is recorded in a cash receipts journal ((Figure)) with a debit to cash and a credit to the source of the cash, whether that is from sales revenue, payment on an account receivable, or some other account.

Cash Receipts Journal. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

(Figure) summarizes the typical transactions in the special journals previously illustrated.

| Types and Purposes of Special Journals | |||

|---|---|---|---|

| Journal Name | Journal Purpose | Account(s) Debited | Account(s) Credited |

| Sales Journal | Sales on credit | Accounts Receivable, Cost of Goods Sold | Sales, Inventory |

| Purchases Journal | Purchases on credit | Inventory | Accounts Payable |

| Cash Disbursements Journal | Paying cash | Could be: Accounts Payable, or other accounts | Cash |

| Cash Receipts Journal | Receiving cash | Cash | Could be: Sales, Accounts Receivable, or other accounts |

| General Journal | Any transaction not covered previously; adjusting and closing entries | Could be: Depreciation Expense | Could be: Accumulated Depreciation |

How will you remember all of this? Remember, "Cash Is King," so we consider cash transactions first. If you receive cash, regardless of the source of the transaction, and even if it is only a part of the transaction, it goes in the cash receipts journal. For example, if the company made a sale for $1,000 and the customer gave $300 in cash and promised to pay the remaining balance in the future, the entire transaction would go into the cash receipts journal, because some cash was received, even if it was only part of a transaction. You could not split this journal entry between two journals, because each transaction's debits must equal the credits or else your journal totals will not balance at the end of the month. You might consider splitting this transaction into two separate transactions and considering it a cash sale for $300 and a sale on account for $700, but that would also be inappropriate. Although the balances in the general ledger accounts would technically be correct if you did that, this is not the right approach. Good internal control dictates that this is a single transaction, associated with one invoice number on a given date, and should be recorded in its entirety in a single journal, which in this case is the cash receipts journal. If any cash is received, even if it is only a part of the transaction, the entire transaction is entered in the cash receipts journal. For this example, the transaction entered in the cash receipts journal would have a debit to cash for $300, a debit to Accounts Receivable for $700, and a credit to Sales for $1,000.

If you pay cash (usually by writing a check), for any reason, even if it is only a part of the transaction, the entire transaction is recorded in the cash disbursements journal. For example, if the company purchased a building for $500,000 and gave a check for $100,000 as a down payment, the entire transaction would be recorded in the cash disbursements journal as a credit to cash for $100,000, a credit to mortgage payable for $400,000, and a debit to buildings for $500,000.

If the transaction does not involve cash, it will be recorded in one of the other special journals. If it is a credit sale (also known as a sale on account), it is recorded in the sales journal. If it is a credit purchase (also known as a purchase on account), it is recorded in the purchases journal. If it is none of the above, it is recorded in the general journal.

Accounting Information Systems

Let's consider what Gearhead Outfitters' accounting information system might look like. What information will company management find important? Likewise, what information might external users of Gearhead's financial reports need? Do regulatory requirements dictate what Gearhead needs to track in its accounting system?

Gearhead will want to know its financial position, results of operations, and cash flows. Such data will help management make decisions about the company. Likewise, external users want this data (balance sheet, income statement, and statement of cash flows) to make decisions such as whether or not to extend credit to Gearhead.

To keep accurate records, company operations must be considered. For example, inventory is purchased, sales are made, customers are billed, cash is collected, employees work and need to be paid, and other expenses are incurred. All of these operations involve different recording processes. Inventory will require a purchases journal. Sales will require a sales journal, cash receipts journal, and accounts receivable subsidiary ledger (discussed later) journal. Payroll and other disbursements will require their own journals to accurately track transactions.

Such journals allow a company to record accounting information and generate financial statements. The data also provides management with the information needed to make sound business decisions. For example, subsidiary ledgers, such as the accounts receivable ledger, provide data about the aging and collectability of receivables. Thus, the proper design, implementation, and maintenance of the accounting information system are vital to a company's sustainability.

What other questions can be answered through the analysis of information gathered by the accounting information system? Think in terms of the timing of inventory orders and cash flow needs. Is there nonfinancial information to extract from the accounting system? An accounting information system should provide the information needed for a business to meet its goals.

Subsidiary Ledgers

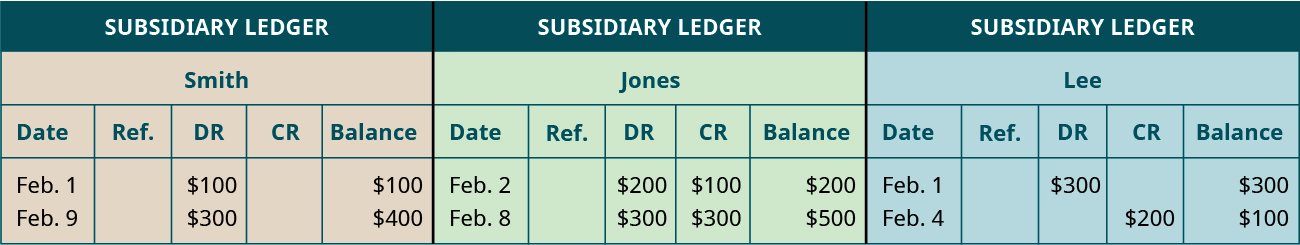

In addition to the four special journals, there are two special ledgers, the accounts receivable subsidiary ledger and the accounts payable subsidiary ledger. The accounts receivable subsidiary ledger gives details about each person who owes the company money, as shown in (Figure). Each colored block represents an individual's account and shows only the amount that person owes the company. Notice that the subsidiary ledger provides the date of the transaction and a reference column to link the transaction to the same information posted in one of the special journals (or general journal if special journals are not used)—this reference is usually a code that references the special journal such as SJ for the sales special journal, as well as the amounts owed in the debit column and the payments made in the credit column. The amounts owed by all of the individuals, as indicated in the subsidiary ledger, are added together to form the accounts receivable control total, and this should equal the Accounts Receivable balance reported in the general ledger as shown in (Figure). Key points about the accounts receivable subsidiary ledger are:

- Accounts Receivable in the general ledger is the total of all of the individual account totals that are listed in the accounts receivable subsidiary ledger.

- All of the amounts owed to the company in the accounts receivable subsidiary ledger must equal the amounts in the accounts receivable general ledger account.

Accounts Receivable Subsidiary Ledger. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Accounts Receivable. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Subsidiary Ledger Fraud1

Subsidiary ledgers have to balance and agree with the general ledger. Accountants using QuickBooks and other accounting systems may not have to perform this step, because in these systems the subsidiary ledger updates the general ledger automatically. However, a dishonest person might manipulate accounting records by recording a smaller amount of cash receipts in the control account than is recorded on the subsidiary ledger cards. The ethical accountant must be vigilant to ensure that the ledgers remain balanced and that proper internal controls are in place to ensure the soundness of the accounting system.

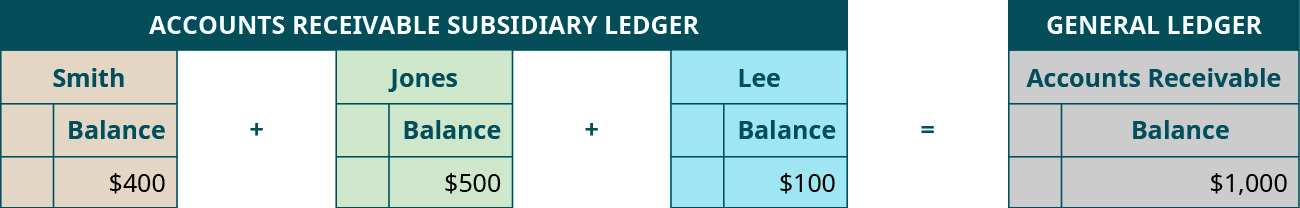

The accounts payable subsidiary ledger holds the details about all of the amounts a company owes to people and/or companies. In the accounts payable subsidiary ledger, each vendor (the person or company from whom you purchased inventory or other items) has an account that shows the details of all transactions. Similar to the accounts receivable subsidiary ledger, the purchases subsidiary journal indicates the date on which a transaction took place; a reference column used in the same manner as previously described for accounts receivable subsidiary ledgers; and finally, the subsidiary ledger shows the amount charged or the amount paid. Following are the transactions for ABC Inc. and XYZ Inc. The final balance indicated on each subsidiary purchases journal shows the amount the company owes ABC and XYZ.

If the two amounts are added together, the company owes $305 in total to the two companies. The $305 is the amount that will show in the Accounts Payable general ledger account.

Using the Accounts Payable Subsidiary Ledger

Find the balance in each account in the accounts payable subsidiary ledger that follows. Note that each vendor account has a unique account number or AP No.

Solution

Key Concepts and Summary

- We use special journals to keep track of similar types of transactions.

- We use special journals to save time because the same types of transactions occur over and over.

- To decide which special journal to use, first ask, "Is cash involved?" If the answer is "Yes," then use either the cash receipts or cash disbursements journal.

- The cash receipts journal always debits cash but can credit almost anything (primarily sales, Accounts Receivable, or a new loan from the bank).

- The cash disbursements journal always credits cash but can debit almost anything (Accounts Payable, Notes Payable, sales returns and allowances, telephone expense, etc.).

- The sales journal always debits Accounts Receivable and always credits Sales. If the company uses a perpetual inventory method, it also debits cost of goods sold and credits inventory.

- The purchases journal always debits Purchases (if using the periodic inventory method) or Inventory (if using the perpetual inventory method) and credits Accounts Payable.

- We post the monthly balance from each of the special journals to the general ledger at the end of the month.

- We post from all journals to the subsidiary ledgers daily.

- We use the general journal for transactions that do not fit anywhere else—generally, for adjusting and closing entries, and can be for sales returns and/or purchase returns.

- The accounts receivable subsidiary ledger contains all of the details about individual accounts.

- The total of the accounts receivable subsidiary ledger must equal the total in the Accounts Receivable general ledger account.

- The accounts payable subsidiary ledger contains all of the details about individual accounts payable accounts.

- The total of the accounts payable subsidiary ledger must equal the total in the Accounts Payable general ledger account.

Multiple Choice

(Figure)An unhappy customer just returned $50 of the items he purchased yesterday when he charged the goods to the company's store credit card. Which special journal would the company use to record this transaction?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)A customer just charged $150 of merchandise on the company's own charge card. Which special journal would the company use to record this transaction?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)A customer just charged $150 of merchandise using MasterCard. Which special journal would the company use to record this transaction?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)The company just took a physical count of inventory and found $75 worth of inventory was unaccounted for. It was either stolen or damaged. Which journal would the company use to record the correction of the error in inventory?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)Your company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)Received a check for $72 from a customer, Mr. White. Mr. White owed you $124. Which journal would the company use to record this transaction?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)You returned damaged goods you had previously purchased from C.C. Rogers Inc. and received a credit memo for $250. Which journal would your company use to record this transaction?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)Sold goods for $650 cash. Which journal would the company use to record this transaction?

- sales journal

- purchases journal

- cash receipts journal

- cash disbursements journal

- general journal

(Figure)Sandren & Co. purchased inventory on credit from Acto Supply Co. for $4,000. Sandren & Co. would record this transaction in the ________.

- general journal

- cash receipts journal

- cash disbursements journal

- purchases journal

- sales journal

Exercise Set A

(Figure)Match the special journal you would use to record the following transactions. Select from the following:

| A. cash receipts journal | i. Sold inventory for cash |

| B. cash disbursements journal | ii. Sold inventory on account |

| C. sales journal | iii. Received cash a week after selling items on credit |

| D. purchases journal | iv. Paid cash to purchase inventory |

| E. general journal | v. Paid a cash dividend to shareholders |

| vi. Sold shares of stock for cash | |

| vii. Bought equipment for cash | |

| viii. Recorded an adjusting entry for supplies | |

| ix. Paid for a purchase of inventory on account within the discount period | |

| x. Paid for a purchase of inventory on account after the discount period has passed |

(Figure)For each of the transactions, state which special journal (sales journal, cash receipts journal, cash disbursements journal, purchases journal, or general journal) and which subsidiary ledger (Accounts Receivable, Accounts Payable, or neither) would be used in recording the transaction.

- Paid utility bill

- Sold inventory on account

- Received but did not pay phone bill

- Bought inventory on account

- Borrowed money from a bank

- Sold old office furniture for cash

- Recorded depreciation

- Accrued payroll at the end of the accounting period

- Sold inventory for cash

- Paid interest on bank loan

Exercise Set B

(Figure)Match the special journal you would use to record the following transactions.

| A. Cash Receipts Journal | i. Took out a loan from the bank |

| B. Cash Disbursements Journal | ii. Paid employee wages |

| C. Sales Journal | iii. Paid income taxes |

| D. Purchases Journal | iv. Sold goods with credit terms 1/10, 2/30, n/60 |

| E. General Journal | v. Purchased inventory with credit terms n/90 |

| vi. Sold inventory for cash | |

| vii. Paid the phone bill | |

| viii. Purchased stock for cash | |

| ix. Recorded depreciation on the factory equipment | |

| x. Returned defective goods purchased on credit to the supplier. The company had not yet paid for them. |

(Figure)For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash Disbursements Journal, Purchases Journal, or General Journal) and which subsidiary ledger (Accounts Receivable, Accounts Payable, neither) would be used in recording the transaction.

- Sold inventory for cash

- Issued common stock for cash

- Received and paid utility bill

- Bought office equipment on account

- Accrued interest on a loan at the end of the accounting period

- Paid a loan payment

- Bought inventory on account

- Paid employees

- Sold inventory on account

- Paid monthly insurance bill

Problem Set A

(Figure)On June 30, Oscar Inc.'s bookkeeper is preparing to close the books for the month. The accounts receivable control total shows a balance of $2,820.76, but the accounts receivable subsidiary ledger shows total account balances of $2,220.76. The accounts receivable subsidiary ledger is shown here. Can you help find the mistake?

Problem Set B

(Figure)On June 30, Isner Inc.'s bookkeeper is preparing to close the books for the month. The accounts receivable control total shows a balance of $550, but the accounts receivable subsidiary ledger shows total account balances of $850. The accounts receivable subsidiary ledger is shown here. Can you help find the mistake?

Thought Provokers

(Figure)Why must the Accounts Receivable account in the general ledger match the totals of all the subsidiary Accounts Receivable accounts?

(Figure)Why would a company use a subsidiary ledger for its Accounts Receivable?

(Figure)If a customer owed your company $100 on the first day of the month, then purchased $200 of goods on credit on the fifth and paid you $50 on fifteenth, the customer's ending balance for the month would show a (debit or credit) of how much?

Footnotes

- 1 Joseph R. Dervaes. "Accounts Receivable Fraud, Part Five: Other Accounting Manipulations." Fraud Magazine. July/August, 2004. http://www.fraud-magazine.com/article.aspx?id=4294967822

Glossary

- accounts payable subsidiary ledger

- special ledger that contains information about all vendors and the amounts we owe them; the total of all accounts in the accounts payable subsidiary ledger must equal the total of accounts payable control account in the general ledger

- accounts receivable control

- accounts receivable account in the general ledger

- accounts receivable subsidiary ledger

- special ledger that contains information about all customers and the amounts they owe; the total of all accounts in the accounts receivable subsidiary ledger must equal the total of accounts receivable control account in the general ledger

- cash disbursements journal

- special journal that is used to record outflows of cash; every time cash leaves the business, usually when we issue a check, we record in this journal

- cash receipts journal

- special journal that is used to record inflows of cash; every time we receive checks and currency from customers and others, we record these cash receipts in this journal

- purchases journal

- special journal that is used to record purchases of merchandise inventory on credit; it always debits the merchandise inventory account (if using the perpetual inventory method) or the Purchases account (if using the periodic method)

- sales journal

- special journal that is used to record all sales on credit; it always debits accounts receivable and credits sales, and if the company uses the perpetual inventory method it also debits cost of goods sold and credits merchandise inventory

- special journal

- book of original entry that is used to record transactions of a similar type in addition to the general journal

System Understanding Aid 9th Solution Manual Full Set Transaction

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/describe-and-explain-the-purpose-of-special-journals-and-their-importance-to-stakeholders/